Amy: Options for investors have evolved and proliferated throughout my career for the better. We have transitioned from a mutual fundcentric world to an ETF-centric world, mostly because of advances in technology (quickly relaying share price information).

As a refresher, both mutual funds and ETFs provide substantial diversification benefits through the baskets of securities that they hold. ETFs are unique because they trade on an exchange (like individual stocks), are fully transparent (you always know exactly what you hold), and have no minimum investment requirements. In most cases, ETFs and mutual funds provide investors with instant diversification of a market (i.e., the S&P 500), sector (Information Technology), or industry (Semiconductors). Since most investors have neither the time nor the inclination to analyze company stocks consistently, both ETFs and mutual funds provide individuals an opportunity to invest for the long term while also responsibly managing risk through diversification.

Tandem primarily utilizes ETFs in the Tandem ETF Portfolios. The main benefits of ETFs are tax efficiency, intra-day liquidity (trading), and a more streamlined fee structure (fewer distribution fees). ETFs may be either passively or actively managed, which is the same as mutual funds.

Angus: Thank you for that explanation. Continuing from the discussion, could you clarify the roles of active vs passive investment management, including why it may make more sense to use one over the other?

Amy: Active managers are trying to exceed the market expectation while a passive strategy is designed to match the market expectation or performance of a specific index. Active management is more work but promises a higher payoff. Therefore, an actively managed strategy is often the pricier option for investors.

Over a 20 to 30-year timeframe, it is very difficult for an active strategy to outperform a specific benchmark, like the S&P 500. However, active management tends to outperform during difficult or volatile markets, so there is a time and a place for its use.

Tandem uses mutual funds when a specific investment strategy is not available within the lowercost ETF market. For example, we are currently using one mutual fund for our investment-grade convertible strategy. In the past, we have also used mutual funds within the international growth and US small-cap stock sectors.

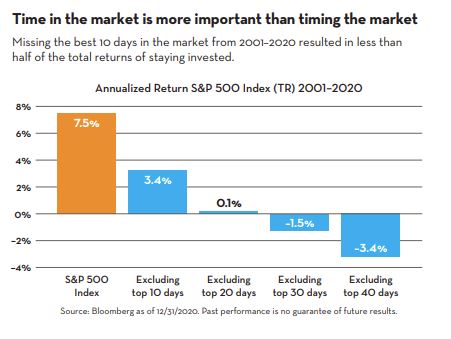

Angus: Whenever we experience periods of volatility in the market, such as a correction, a bear market, or even a recession, it can be tempting to sell and sit in cash. Unfortunately, this can have the opposite of its intended effect and do more long-term damage to a portfolio than staying invested. Could you touch on some additional thoughts, and reasoning behind this?

Amy: As the chart below indicates, if you are sitting in cash, missing just a few days in the market can make a big difference in your portfolio’s return. Investors that stay invested during a downturn will likely see a smaller negative result than investors who sell and reinvest when the market is higher in the future. It is impossible to time the market, and investors risk missing out on major gains as the market begins to recover. Historically, the best days in the market occur very close to the worst days around a market bottom. Daily market movements are unpredictable, sometimes based on fundamental changes in data or policy change, other times based on participant emotion, and sometimes based on technical factors. We are fundamental, long-term investors at Tandem, not market timers. I like to think of the market as a very long, upward-sloping road. And at times we experience a few depressions in the road, but in general, the slope is upwards. It helps me create perspective when markets are moving lower and avoid short-term thinking. Currently, the market is determining the appropriate multiple or price-earnings ratio (PE) for stocks when the cost of capital is increasing. This is a process. Be patient. Stay invested. Stay diversified and balanced.

Angus: Thank you for your time today, and we look forward to your ongoing insights.