On the center is a photo I took from last fall on one of my favorite bike climbs near Aspen.

The scenery obviously takes my mind off the hard work of climbing. The fun comes after the climb—on the speedy descent.

We still have some hard work ahead of us in the form of normalizing higher interest rates. That will strengthen the economy in the long run, as the excess continues to drain from the system.

Angus: With all of the volatility we have been experiencing in the market lately, can you talk about the importance of having a well-balanced, diversified portfolio?

Amy: Balance and diversification reduces volatility. In other words, it reduces big swings in the market value of your portfolio. Holding a variety of stocks and bonds, or ETFs, limits your exposure to any one financial asset. This helps to spread the risk and return opportunity across multiple holdings. The goal is to reduce the impact from large price swings in a single security or investment.

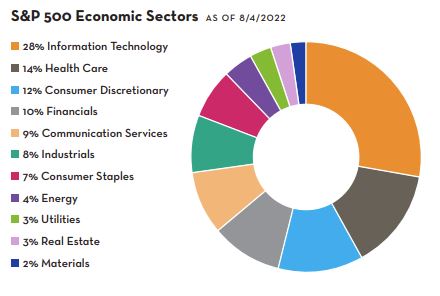

We provide balance by including both stocks and bonds. The stock portion of the portfolio is invested in large, medium and small companies—both domestic and international. Exposure to each of the 11 economic sectors provides an additional layer of diversification. We invest predominantly in US companies, but added diversification is provided by including ETFs with stocks from both developed and emerging countries. Our bonds are mostly US investment grade companies, meaning their credit history and/or balance sheets are of the highest quality with the strongest ability to repay their debts.

Angus: Thank you for that explanation. Expanding on the last question a bit more, what considerations do you normally take into account when deciding to add or remove a particular sector or asset class from the portfolio? Amy: Investors will normally see changes in their portfolio when the business cycle changes. Two big factors make the cycle move: changes in the cost of money (interest rates) and changes in the cost of goods (commodities and labor). Higher levels in all three of these factors have caused a slowdown in our economy and around the world. If monetary or fiscal policy is changing, we will normally have to make an adjustment to the portfolio. Some economic sectors do better when the economy contracts, others when the economy expands. We use trends in economic data to help us anticipate big turns in the business cycle, which then helps us to determine which sectors to emphasize in the portfolio. Changes to the bond portion of the portfolio are less frequent—mostly occurring when the Fed tells investors they are changing the direction of monetary policy.

Angus: Certainly there are a variety of factors that have been impacting the market and economy so far this year. I wanted to get your thoughts around the ongoing war in Ukraine and what impact you see this having on the global economy, as well as here in the US? Amy: Investors dislike uncertainty, and war increases economic uncertainty. In this case, Europe’s dependence on Russia for oil, and Ukraine for food, exposes the fragility of those intertwined economies. Coming on the heels of the pandemic in the face of rising global interest rates means a more difficult economy looms ahead for the Eurozone. Eventually that will hurt US companies that sell their goods and services in that area of the world. Everything is connected.

Also problematic for the US is higher tension between the US and China regarding Taiwan. This exposes our dependence on Asia for semiconductor production. Of course, maintaining a balanced and well-diversified portfolio means our exposure to any one of these risks is minimized.

Angus: Thank you for your time today, and we look forward to your ongoing insights.