My role at Tandem is similar: determining the investments or asset allocation within a broadly diversified portfolio. We follow a consistent process of analyzing the economy and business cycle from the top down.

Angus: Thank you. We had a few topics of conversation today that we wanted to run by you and get your thoughts on. First, we wanted to talk about inflation. Could you give us your thoughts around inflation in the market today? What longer term concerns do you have around inflation?

Angus: During the last expansion ending with the pandemic, inflation was barely an investor concern, rarely exceeding 2%. Injecting the economy with stimulus that totaled nearly 50% of GDP at the same time that supply chains were breaking down unleashed a crushing inflationary wave that is still rolling but slowing. It is both a demand and supply problem.

The Fed’s rate hiking cycle is intended to combat inflation by making credit more expensive for both consumers and businesses (in other words, demand destruction). It takes time though for higher rates to work through the system. The Fed can’t fix our supply chain problems, which is a more complex longer term issue. Finally, labor supply is tight, specifically in the service arena, for a variety of reasons. As a result, we expect overall inflation to eventually settle at a higher rate than in the previous expansion, but it is extremely difficult to predict. Once embedded, it can be very difficult to squash.

Angus: There seems to be more talk recently about whether we are in a recession, or if we see the potential for a recession in the near future. Could you touch on any concerns you may have about a recession and address some of the leading economic indicators that we have been following?

Amy: Technically, a recession is two consecutive quarters of negative economic growth or GDP. It is a very delicate task trying to slow the economy to quell inflation with monetary policy, but not too much so that we come to a standstill. The Fed’s job is difficult, and their tools are not that precise. Complicating things further, inflation is a lagging indicator, meaning we are measuring something already in the rearview mirror. Chairman Powell indicated the Fed will do what it takes to stop inflation, so there is definitely a risk the Fed tightens too much, pushing us into a recession. Historically, Fed action in both directions tends to be overzealous. The Fed has already admitted that their analysis of the inflationary environment was incorrect. Their “course correct” is worrisome to investors.

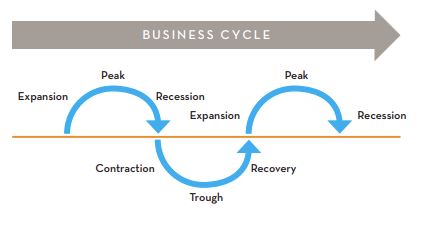

We use macroeconomic indicators to help us determine where we are in the business cycle. This helps us then determine the most appropriate investments during that portion of the cycle. While we examine over 100 different economic variables, we focus on a handful of “leading indicators” that provide clues about the future. These include: PMI indices, initial jobless claims, credit spreads, confidence indices, changes in the shape of the yield curve, Fed action, and the price of the S&P 500.

One of our favorites is the ISM Manufacturing Report on New Orders Index (a PMI index). This indicator is a good proxy for the economy and corporate earnings going forward. A number greater than 50 indicates expansion, while a number less than 50 indicates contraction. In June, the index fell below 50 for the first time in two years after peaking about one year ago. We have been slowing for about a year, just off of a torrid pace.

Angus: Finally, could you touch on some of your thoughts around the business cycle and where you see us headed over the course of the next year?

Amy: We are in the latter portion of the business cycle, where both revenue and earnings growth are starting to slow and in some cases turn negative. Consequently, we have been increasing the “defensiveness” of the portfolio by increasing our investments within the Consumer Staples, Health Care and Utilities sectors. We will likely be in a recession in the next year. Angus: Thank you for your time today! We look forward to your ongoing insights.