The bond portion of the convertible provides downside support in the form of a semi-annual coupon payment and a stated maturity date which acts as a theoretical “bond floor”. The equity call option provides potential capital growth through equity appreciation. Considered a convex security, on average, the price of a convertible rises at an increasing rate as its underling stock rises, but falls at a decreasing rate, as the underlying stock falls. It is this attribute that gives the asset class such an attractive return profile through total market cycles.

Some convertibles are different than others… convertibles generally fall into three broad categories after issuance, depending on the movement and direction of the underlying common stock. Equity-sensitive convertibles generally move with the underlying stock on a one for one basis. A credit-sensitive convertible security trades on its credit fundamentals while a total return convertible moves modestly with underlying stock price movement. Most are issued with a credit rating, either investment grade or below investment grade (junk), while others are not rated (NR).

Portfolio managers have the discretion to construct convertible portfolios based on a combination of convertible attributes, and in general, an active approach to convertible portfolio management is preferred over the use of a passive index ETF in order to manage the overall equity sensitivity of the portfolio.

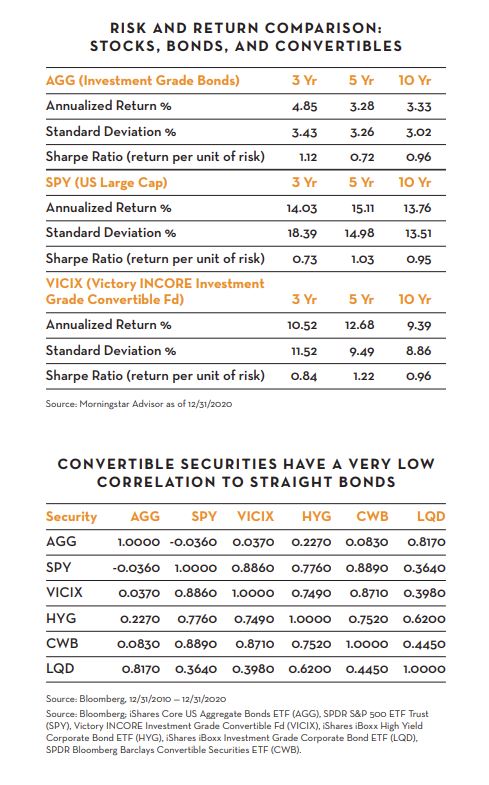

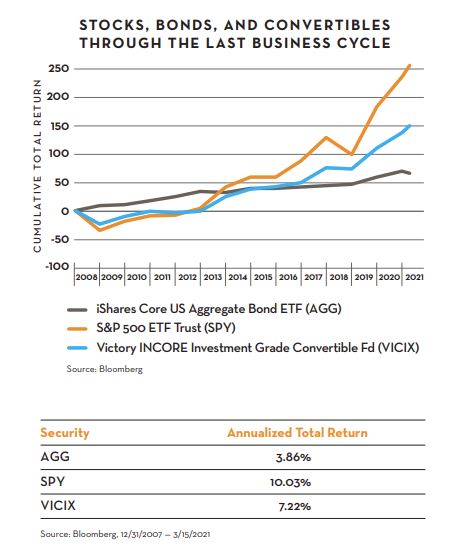

Asset allocators may use convertibles to either cushion equity returns in a volatile market or to enhance fixed income returns in a low-rate environment.

Convertibles have historically performed particularly well in a rising interestrate environment when the economy is improving due to their low duration and sensitivity to common stocks.

By replacing a portion of our bond exposure with convertibles through total market cycles, we may potentially improve the risk/return profile of the bond portion of the portfolio.